HSA Medical Devices: Rules, Eligibility, and Tax Benefits

Health Savings Accounts, more commonly known as HSAs, have become an increasingly popular way for individuals and families to manage healthcare expenses. These accounts are especially appealing because they combine savings flexibility with significant tax advantages.

While many people are familiar with using HSAs to pay for doctor visits, prescriptions, or hospital services, fewer realize that certain medical devices are also eligible. Understanding the rules around HSA medical devices, the eligibility criteria, and the tax benefits can help you make smarter financial and healthcare decisions.

What Is an HSA and How Does It Work?

An HSA is a special type of savings account designed for people with high-deductible health insurance plans. The main purpose of this account is to set aside pre-tax money to pay for qualified medical expenses. Because contributions are tax-deductible and withdrawals for approved expenses are tax-free, HSAs offer one of the most powerful ways to save money on healthcare. Unlike flexible spending accounts, the money in an HSA rolls over year after year, meaning you can build long-term savings while still having access to funds for immediate medical needs.

Understanding HSA-Eligible Medical Devices

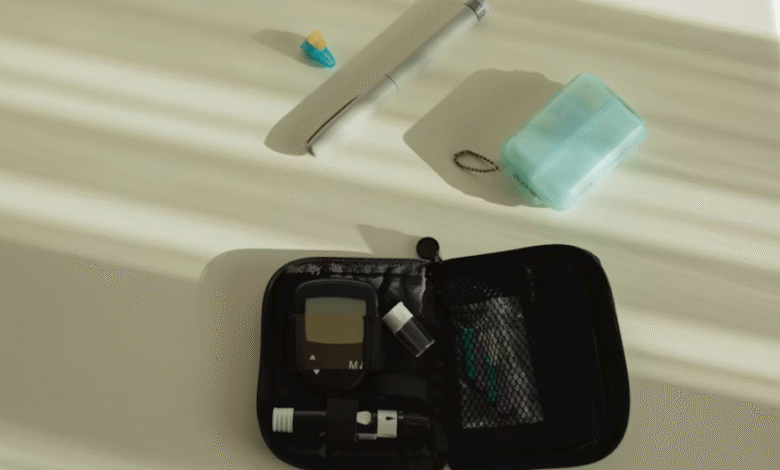

Medical devices eligible for HSA use include a wide range of products that are primarily intended to diagnose, treat, or prevent medical conditions. These devices can range from everyday healthcare tools to more specialized equipment. The key factor is that the device must serve a legitimate medical purpose and not simply be a convenience or cosmetic item. For example, a device prescribed by a doctor to monitor a chronic condition will typically qualify, while products used for general wellness without medical necessity may not.

It is also worth noting that the IRS updates guidelines on qualified medical expenses from time to time. This means that while some items are clearly eligible, others may require documentation or a letter of medical necessity from your healthcare provider. Being aware of these rules helps avoid confusion and ensures that you use your HSA correctly.

Rules for Using HSAs on Medical Devices

The rules for using HSAs to purchase medical devices are relatively straightforward, but they must be followed carefully to avoid penalties. First, the purchase must be for a device that qualifies under the IRS guidelines for medical expenses. If a product is considered non-essential, cosmetic, or primarily for general use, it may not be eligible. Second, the device must be for you, your spouse, or your dependents in order to be covered by your HSA. Attempting to use HSA funds for someone outside your immediate tax household will not qualify.

Another important rule is proper recordkeeping. You are responsible for keeping receipts, invoices, or prescriptions that demonstrate your purchase was valid. In the event of an IRS audit, you may be asked to provide proof that the funds were used appropriately. Misuse of HSA funds, such as purchasing non-qualified items, can lead to tax penalties and additional income taxes on the withdrawn amount.

See also: Understanding Sports Injuries: Prevention, Recovery, and Long-Term Health

Eligibility Criteria for Devices

Not every medical device automatically qualifies for HSA spending. Devices that are clearly tied to the treatment, diagnosis, or monitoring of medical conditions generally meet eligibility requirements. This can include equipment for chronic disease management, devices that help with recovery after surgery, or monitoring tools prescribed by a doctor.

In some cases, you may need a healthcare provider’s recommendation to confirm eligibility. For instance, certain health-related items may be classified as dual-purpose because they can be used for both medical and non-medical reasons. In these situations, your doctor can write a letter of medical necessity explaining why the device is required for your specific health condition. This documentation can then be kept with your tax records to justify the expense.

Tax Benefits of Using HSAs for Medical Devices

The tax advantages of using an HSA for medical devices can make a significant difference in long-term financial planning.

Tax-Free Contributions

Money deposited into an HSA is pre-tax or tax-deductible. This reduces your taxable income, giving you an immediate financial advantage.

Tax-Free Growth

Funds in an HSA grow tax-free, whether in a basic savings account or an investment portfolio. This means that any growth in your account value can later be applied to medical expenses without tax consequences.

Tax-Free Withdrawals

When you use your HSA to purchase qualified medical devices, the withdrawals are completely tax-free. This triple benefit is what makes HSAs one of the most effective healthcare and retirement planning tools.

Long-Term Advantage

Even if you don’t need medical devices immediately, your HSA can act as a healthcare nest egg. Since funds roll over year to year, you can save for future expenses, such as hearing aids, which are often necessary in later stages of life.

Future Trends in HSA Medical Device Coverage

With the rise of telehealth and smart medical technology, the definition of “medical device” is gradually expanding. For example, remote monitoring tools that track heart rate, oxygen levels, or blood pressure could soon be more broadly recognized as eligible HSA expenses.

As regulations evolve, it’s worth staying updated on IRS guidelines and any legislative changes that impact HSA-qualified devices. This ensures you continue to maximize both your health benefits and financial advantages.

Conclusion

HSA medical devices are an important part of managing both health and finances. By understanding the rules, eligibility requirements, and tax benefits, you can make smarter decisions about your purchases. From essential diagnostic tools like glucose meters to life-improving devices like hearing aids, HSAs offer a tax-efficient way to cover these expenses.

With careful planning, strategic use of funds, and proper documentation, your HSA can become a powerful resource for handling healthcare costs today and in the future.